However, the budget should be high-level enough so as to not be cluttered and overwhelming. While there will inevitably be some assumptions in your budget, try to work with real numbers as much as possible. Use last year’s numbers as a starting place and include any https://greatercollinwood.org/main-benefits-of-accounting-services-for-nonprofit-organizations/ quotes from vendors or partners. The two primary components of a budget are income and revenue, and many subcategories fall under the umbrella of each.

Marketing

- Start with your known fixed costs like rent, utilities, salaries and insurance.

- They can mean the difference between surviving a rough patch and being forced to close down.

- We strive to provide nonprofit leaders with useful resources, tips, and tools that you can use at your organization.

- Make adjustments as necessary to ensure that the budget aligns with your organization’s goals, priorities, and financial realities.

- Set aside a portion of your budget for unforeseen expenses or emergencies.

In order for nonprofits to determine how much money they require to operate, they need an accurate way to account for all income and costs. Use this budget for nonprofit project template to determine where you have room to grow and where you might need to cut back. Historic data is the most reliable information you can use for creating a budget.

Facilities Expenses

- Small community organizations just starting their budget planning process have found the simplified templates an invaluable starting point.

- The National Council of Nonprofits Budget Toolkit has seen widespread adoption across the nonprofit sector.

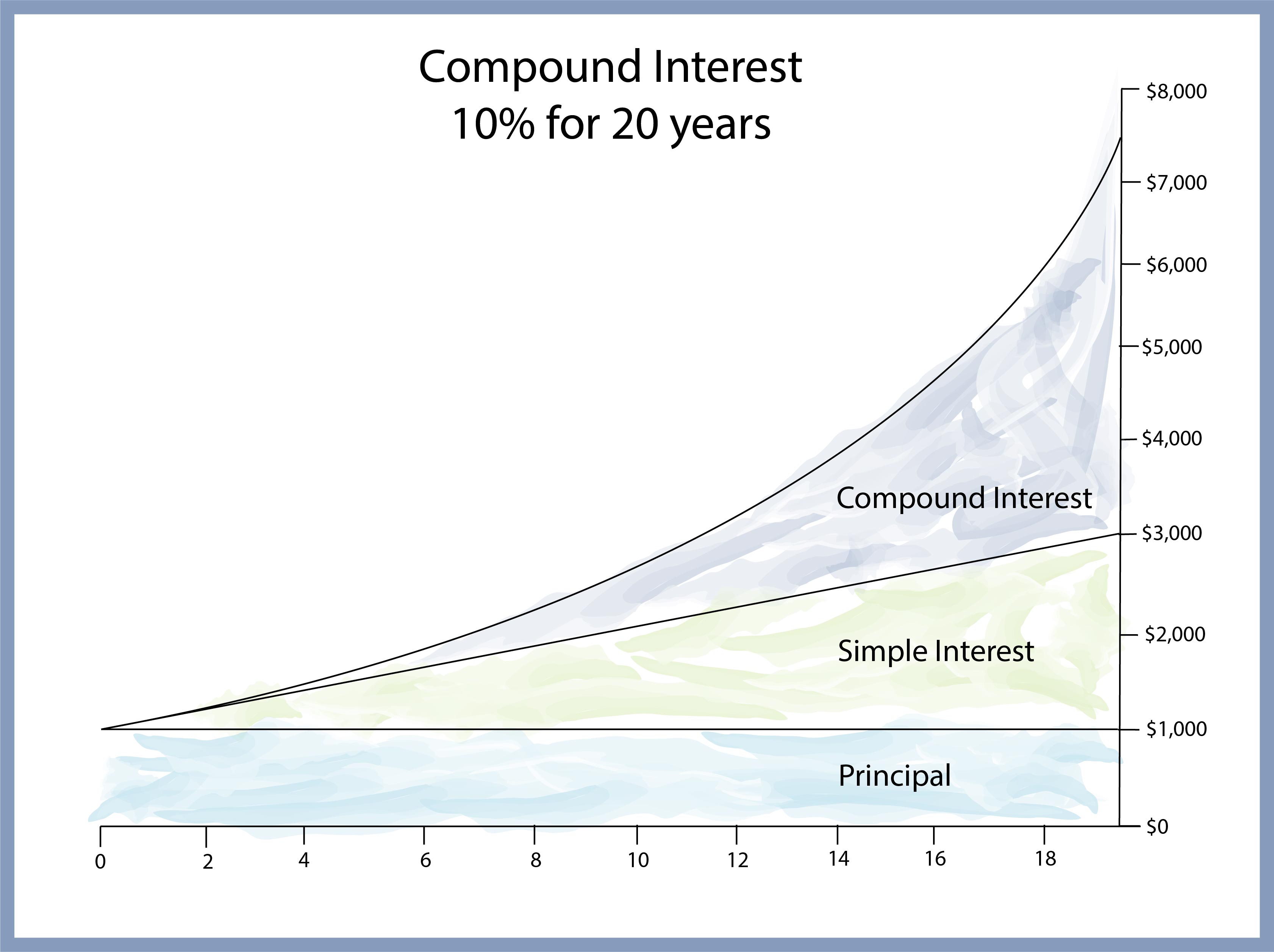

- Most financial experts recommend nonprofits maintain cash reserves equal to 3-6 months of operating expenses.

- To help you get started, we’ve created a basic nonprofit budget template to track your revenue and expenses.

- If there are any changes you need to make now and then, then do not forget to do so.

In order to be as effective as possible with your nonprofit budget, you need to be strategic about how you use your money. The first step in creating a nonprofit budget is to determine the organization’s financial goals and objectives. This will help accounting services for nonprofit organizations to ensure that the budget is aligned with the organization’s overall strategy and that resources are being allocated in a way that supports the achievement of these goals. During your last budget review meeting of each quarter, review your financial data more closely and take more time to visualize the current and future state of your organization’s activities. A well-structured nonprofit budget serves as your organization’s financial planning roadmap, guiding decisions about program investments, staffing needs, and growth opportunities. This becomes particularly important when balancing mission-driven goals with fiscal responsibility, whether you’re running a local charity or a growing foundation.

Evaluate and Learn from the Budgeting Process

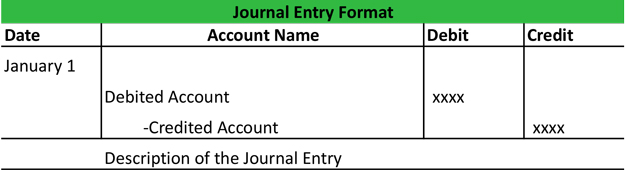

This ensures a comprehensive and accurate overview of an organization’s financial situation, facilitating effective budgeting. Nonprofit budgeting is a crucial aspect of managing a nonprofit organization’s finances. It helps ensure that resources are allocated effectively to achieve the organization’s mission and goals. This step-by-step guide with practical details will help you create a well-structured and efficient nonprofit budget. Editable fields enable you to overwrite example figures (including revenue and expenses) with your own. This fully customizable template helps you determine your organization’s monthly, quarterly, and yearly net income so that you can gauge the financial health of your nonprofit’s budgeted operations.

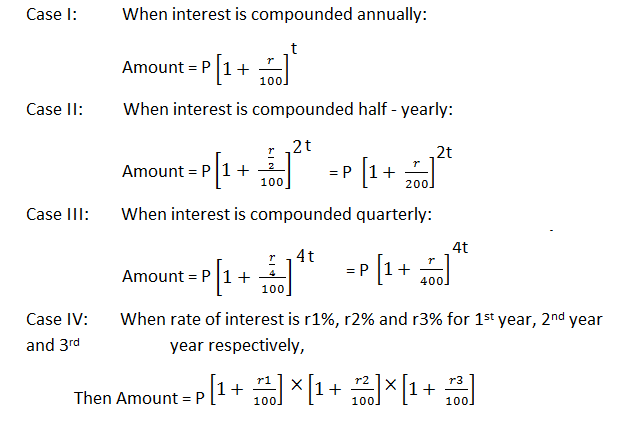

Google Ad Grants provide eligible nonprofits a $10,000 monthly stipend to spend on paid search ads, helping supplement their marketing budgets. While regular Google Ad accounts have to pay per ad click, Google Grant participants can display their advertisements for free. These ads enable your nonprofit to appear on Google when someone searches for topics related to your mission. The average small business using Google Ads spends between $5,000 and $12,000 per month on Google paid search campaigns. That’s $60,000 to $150,000 of marketing expenses per year spent solely on ad clicks. Thankfully, Google created a grant to help nonprofits budget for marketing.

tips for creating budgets at nonprofit organizations

- When your predicted income exceeds your projected expenses, you’ll be more prepared to course correct if you incur unexpected costs or some revenue sources fall short of your goals.

- To clear up any confusion surrounding these resources, we’ll begin by answering some common questions about nonprofit budgets.

- This step-by-step guide with practical details will help you create a well-structured and efficient nonprofit budget.

- Remember to include, record, and track non-monetary contributions with you budget.

- A regularly updated and realistic budget helps you know exactly how much money is coming in and out of your organization, allowing you to manage your resources more effectively.

- In this article, we’ll discuss what is a nonprofit budget, its importance, 12 best practices, a free template, and more.

- Plus, Givebutter’s comprehensive fundraising platform includes a built-in CRM, marketing and engagement tools, and world-class fundraising features—all designed to help you reach your goal.

By doing so, you can keep an eye on your big-picture forecast with the assurance that every detail of your accounting is in order. Nonprofits can keep tabs on their annual program revenue vs. expenses with this easy-to-use nonprofit program-based budget template. Enter fundraising, grant, and other income figures to compare your nonprofit’s current budget to your year-to-date actual revenue. Keep monthly and quarterly tabs on your nonprofit’s cash flow with this all-inclusive, customizable template. Pre-filled income sources — such as grants, donations, etc. — enable you to track monthly and quarterly income actuals.