Keep in mind that although interest might be compounded daily, for instance, the compounded interest might be paid out once a month. If you’re borrowing money, you’ll pay less over time with simple interest. Imagine you have an interest rate of 10%, a principal amount of $100, and a period of two years. For example, if a market index provided total returns of 5% over a five-year period, but a fund manager has only provided 4%, then they are underperforming relative to the market. Calculate percentage additions and deductions with our handy calculator.

Compound Interest & Simple Interest Examples (w/ Formulas!)

The concept of compounding is especially problematic for credit card balances. Not only is the interest rate on credit card debt high, but the interest charges also may be added to the principal balance and incur interest assessments on itself in the future. Investing in dividend growth stocks on top of reinvesting dividends adds another layer of compounding to this strategy that some investors refer to as double compounding. In this case, not only are dividends being reinvested to buy more shares, but these dividend growth stocks are also increasing their per-share payouts. Compounding typically refers to the increasing value of an asset due to the interest earned on both a principal and an accumulated interest.

Compound Annual Growth Rate (CAGR)

Under this method, the interest is charged only on the amount originally lent (principal amount) to the borrower. Interest is not charged on any accumulated interest under this method. Compound Interest can be defined as when the sum principal amount exceeds the due date for payment, along with the rate of interest for a period of time. This formula assumes that no additional changes outside of interest are made to the original principal balance. The banks apply simple interest on loans, such as car loans, student loans,consumer loans etc.

Show answerHide answer

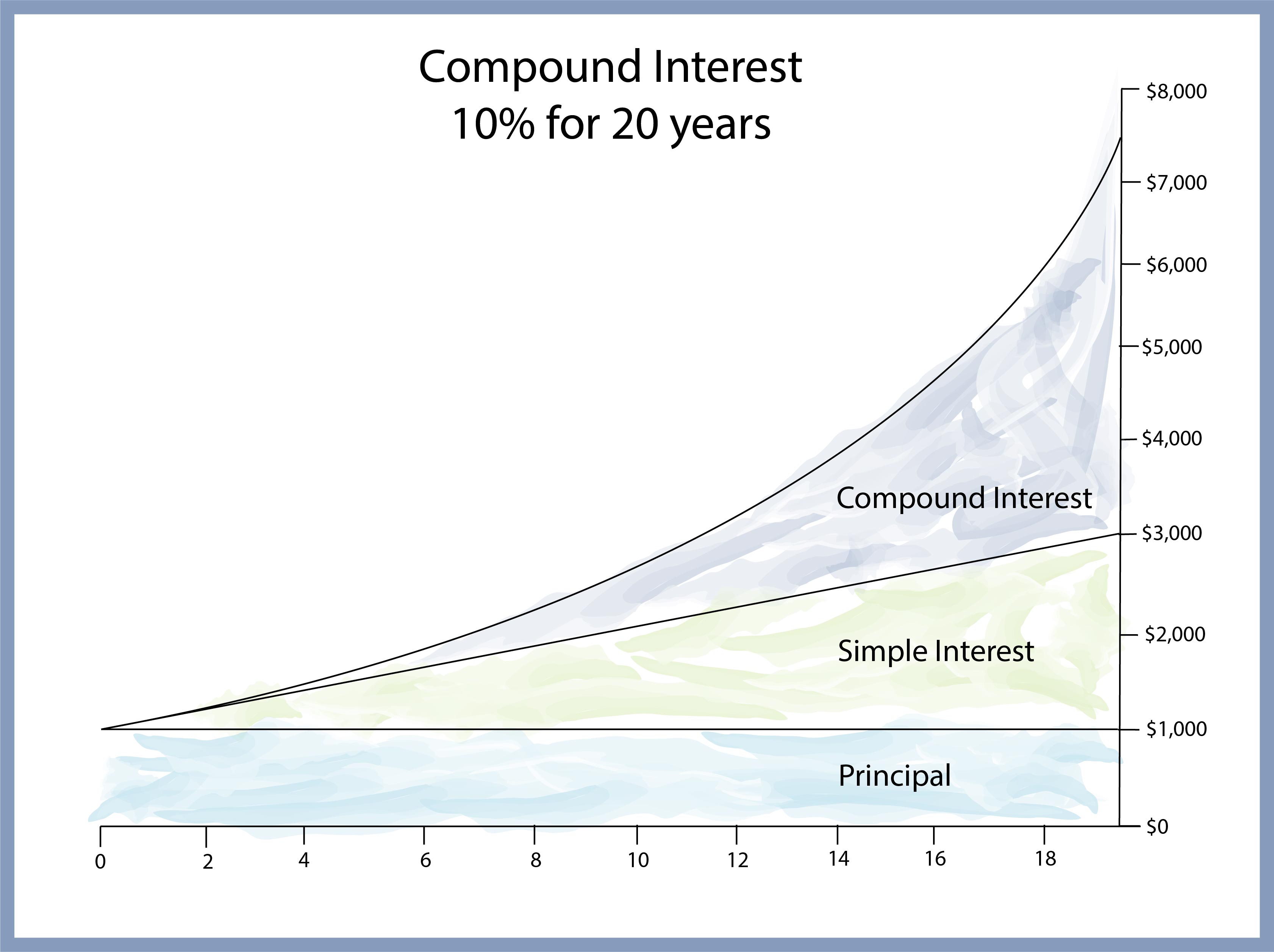

Compound interest is calculated on the principal amount and accumulated interest from previous periods. You typically find compound interest on savings accounts and mortgages. Compound interest can make your funds grow faster in a savings account or make your loan repayments more expensive. Let’s look at how this would play out with Sam’s $10,000 if he wanted about wheres my refund to know how much he would earn after 1 year of daily compounding with a 5% annual interest rate. If an amount of $5,000 is deposited into a savings account at an annual interest rate of 3%, compounded monthly, with additional deposits of $100 per month(made at the end of each month). The value of the investment after 10 years can be calculated as follows…

A credit card balance of $25,000 carrying at an interest rate of 20% compounded monthly would result in a total interest charge of $5,485 over one year or $457 per month. Even if you make loan payments, compounding interest may result in the amount of money you owe being greater in future periods. Let’s begin by looking at simple interest, and then see how banks extend this idea to everyday business. First, what does it mean to invest a principal amount of money P in a bank at a simple interest rate r? The amount of extra money depends on the interest rate that the bank pays and the period of time.

Difference Between Simple Interest and Compound Interest

The total compound interest amount is $20.09 at the end of one year. Simple interest is calculated on the principal amount (the original amount borrowed or deposited into an investment). You may see simple interest on certificates of deposit, coupon-paying bonds, and consumer loans.

Whereas when the interest is calculated on the initial amount and the interest accumulated over a period of time is called as compound interest. You can calculate the potential return on an investment based on the principal deposit and compound interest rate. It is important information to help you decide whether you want to pursue a financial decision or not. You can weigh your options to determine the best choices to make based on your situation. A younger individual also has more opportunities to grow their savings and investments.

We saved this example for last because it illustrates exactly how important compound interest is if you want to save for your retirement. Even if you don’t invest in the stock market or take big risks, you can accumulate a lot of money if you choose a compound savings account and leave your money there, so it can grow. The long-term effect of compound interest on savings and investments is indeed powerful.

- The interest for the second year will be computed on $105 and at the end of second year you will have $110.25 ($105 principal + 5.25 interest).

- The Rule of 72 helps you estimate how long it will take your investment to double if you have a fixed annual interest rate.

- Because the interest is compounded, it is added to the principal to determine the accumulated amount of $11,200 at the end of the year.

- The banks apply simple interest on loans, such as car loans, student loans,consumer loans etc.

- Compound interest means that interest is computed on the principal of the note plus any interest that has accrued to date.

- After the first year or compounding period, the total in the account has risen to $10,500, a simple reflection of $500 in interest being added to the $10,000 principal.

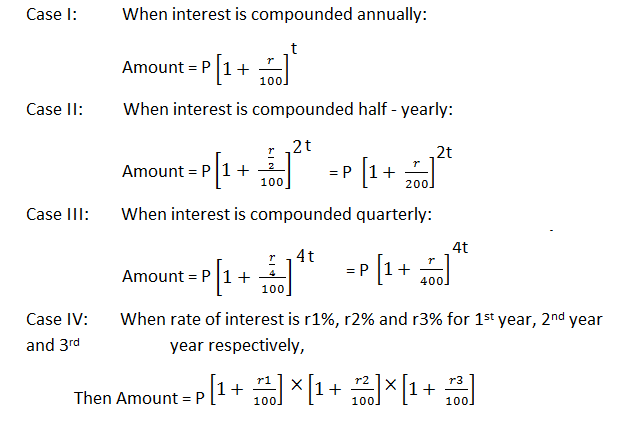

The following diagram shows the simple interest formula and compound interest formula. Assets that have dividends, like dividend stocks or mutual funds, offer a one way for investors to take advantage of compound interest. Reinvested dividends are used to purchase more shares of the asset. An investor opting for a brokerage account’s dividend reinvestment plan (DRIP) is essentially using the power of compounding in their investments.

It’s also used to ascertain whether a mutual fund manager or portfolio manager has exceeded the market’s rate of return over a period. Simple interest means there is no “interest on interest.” With a loan, a borrower would not pay interest on accrued interest. With savings or investments, an account holder would not earn interest on accrued interest. As it relates to loans, simple interest refers to the amount of interest paid on the principal, or original amount borrowed. In other words, the borrower does not pay interest on the interest being charged.