When lenders are considering a company loan application, there are a number of points they be the cause of. The first basis ‘s the businesss capacity to repay new financing. Lenders might look at the businesss credit rating, equity, in addition to owners private guarantee.

The ability to repay the loan is the most important factor in determining whether or not a lender will approve a small business loan. Lenders will typically look at the businesss cash flow and financial statements to get an idea of the businesss ability to repay the loan. They will also look at the businesss overall financial health, including its earnings and financial obligation-to-security ratio.

Lenders use this short article to obtain a better understanding of their businesss economic health insurance and to decide if you’re able to pay for the mortgage

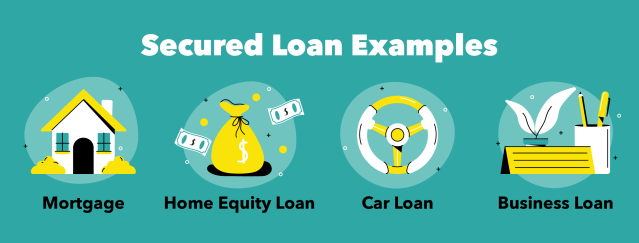

Collateral is another important factor that lenders consider when approving a small business loan. guarantee is something of value used to help you safe the loan, such as real estate, equipment, or inventory. If the debtor non-payments into financing, the lender can seize the collateral to recoup their losses.

Proprietors private be certain that is additionally an important facet one lenders consider whenever giving a business loan. Your own be certain that means who owns the firm try myself responsible for paying down the loan if your business never manage so.