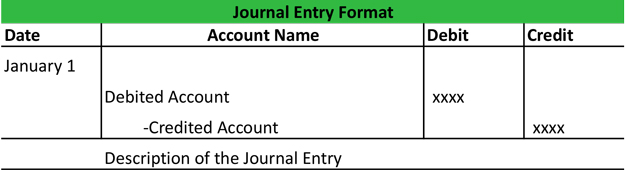

A Journal Entry is a formal method of recording transactions using debits and credits. The recording of journal entries needs to follow the debit and credit roles. For example, expenses are increasing in debit, and revenues are increasing in credit. The same as a general journal, the special journal is used in the manual accounting system only. If the entity uses a system to records its accounting transaction, there is no special journal use. We discussed the use of journals in recording the Company’s transactions and its use in general journal accounting.

How Liam Passed His CPA Exams by Tweaking His Study Process

In accounting, a general journal is a record where all business transactions are initially recorded, using the double-entry accounting method, before they are posted to the ledger accounts. The general journal is often called the book of original entry, as it’s the first place the transactions are recorded. A journal entry records financial transactions that a business engages in throughout the accounting period.

- When making entries in the general journal, it’s easy to make mistakes.

- Actually, we simply transferred the amount from receivable to cash in the above entry.

- An Accounting Journal is a record containing a chronological listing of business transactions.

- After carrying out a business transaction, it is recorded in a book known as the general journal.

- General journals are also known as an “individual journal” or “book of original entry.” These records may contain information about cash receipts and payments.

Debit

However, both the debit entries and credit entries should still have total amounts that equal each other. The general journal was more visible in the days of manual record keeping. With nearly everyone now using accounting software to record their accounting transactions, it is not so readily apparent. Instead, the software makes it appear as though all transactions center around the general ledger, with no specialty journals in use at all. Most bookkeepers don’t actually have to manually transfer all the company’s transactions from the general journal to the ledgers.

Entries in General Journal

For example, any journal entries related to sales transactions should transfer to sales ledgers, and all the transfers must respect the debit and credit rule. The increase in leveraged lease financial definition of leveraged lease sales should be recorded on the credit side of the sales ledger. The entity also records other non-financial transactions that occur in the business into this book also.

Journal entries: More examples

Also, you have to debit all expenses and losses and credit all incomes and gains. The next columns that come after the Post Ref column are the Debit and Credit columns, with the credited account being placed one row below the debited account. The debit column of the general journal is used to record the amounts of the accounts that are debited while the credit column is used to record the amounts of the accounts that are credited. The entry made in the debit and credit columns states the dollar amounts that have been spent or that need to be transferred between accounts.

However, despite the conveniences offered by these journals, using a computerized accounting system greatly enhances the efficiency of your entire accounting process. The column headings in a combination journal will depend on the needs of your business. Back in the day of manual accounting systems, the accounting department would manage countless journals and ledgers that contain all bookkeeping records. Recording business transactions in the general journal using journal entries is the second step in the accounting cycle of the business. The Accounting Cycle refers to the steps that a company takes to prepare financial statements.

An individual trader or a professional fund manager can form a journal where he records the details of the trades made during the day. These records can be used for taxation, audit, and evaluation purposes. All other transactions not entered in a specialty journal account for in a General Journal. It can have the transactions related to Accounts receivables, Accounts payable, Equipment, Accumulated depreciation, Expenses, Interest income and expenses, etc. The description of the transaction assists bookkeepers and accountants to recall what exactly happened on a certain date or why a transaction occurred.

It also helps reduce the possibility of errors that are usually inherent in manual accounting systems. Using a computerized accounting system completely eliminates the need to create a journal entry such as the example above. This is already automatically done in the background by the system as you enter the details of a transaction in the fields provided by the software.

In the above table of general journal examples, we can see each transaction as two lines- one debit and one credit account. You are likely to make mistakes when using journals, thus, you can easily check for mistakes by adding both sides of your journal entry together. If they do not equal the same number, then there is an error nd you should know that something has gone wrong. Credit accounts are those account which decreases when there are transactions.