To start with it was effortless. I became a legal professional. He had been a professional. I made approximately the same paycheck. But then I thought i’d briefly go on to Colorado to greatly help work with an effective CBD legalization promotion.

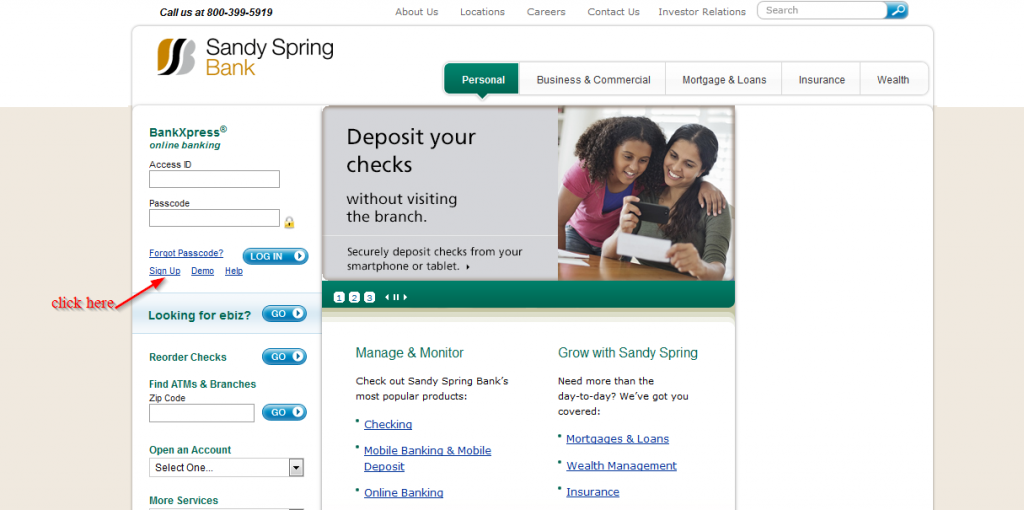

I took a pay slash because it was exhilarating to be part of history. However, exhilaration cannot pay one or two rents. That is once we already been playing with budgeting app – though you go for any system you want, this new HerMoney lover favorite was YouNeedABudget (YNAB).

Just before We remaining for Colorado, we invested a day with the all of our funds, starting allowances for every single of our repaired month-to-month expenses and finding out how much we can per invest in discretionary expenditures. I knew we are able to generate our budget practical if we factored in a few liberty to own random anything we purchase whenever we are stressed, having a great time, or perhaps happy to pay money for comfort one date – one to small amusement group for every people.

Generally, the two of us utilized the recreation costs for $3 java. Especially while you are life thus frugally, it sensed a good and you will edgy to invest certain shame-free cash damaging the suggestions of any cam show economic agent.

Maternity, Difficulty plus one Paycheck

Whenever i came back the home of Boston, it had been a special celebration once we updated the cost management app to help you reflect a single rent bills and two elite-peak salaries. That was the master plan, anyway, up to after one to cold weather as i learned I found myself expecting – and an ailment named hyperemesis gravidarum (a scientific identity for unrelenting vomiting) took more than me.

The second several months was indeed an effective blur. Somewhere within a healthcare facility check outs and you may nausea, my hubby gone me to a smaller sized apartment so we you can expect to create on a single paycheck up until I returned to get results.

Up to my second trimester, I arrive at become a small greatest. But We nevertheless was not operating, so we returned to our budgeting software’s business display and rewrote our budgets to fund two-and-a-half those with you to paycheck. We’d to help you scrimp, but i generated the newest finances performs.

In the beginning, they didn’t really happen to me personally which i was life style out-of my personal wife or husband’s income. We continued and make financial conclusion together, and that i is sticking with my budget and you will investing bills aside out-of my account as ever.

However, someday in my 3rd trimester, We visited spend my mastercard bill and you may pointed out that I did not have enough to fund my harmony. It actually was next so it earliest struck me personally that there is always to be unique monetary advice about stay-at-domestic mom who are not making a full time income.

I didn’t enjoys a paycheck upcoming. We envisioned him taking a look at the report and you may thinking the latest Sephora fees. Create I need to show him the newest Dior eyeliner I buy month-to-month? Let’s say the guy thought $31 having good crayon are unrealistic?

This is what It Sit-At-House Mommy Performed

He explained so you can email him the quantity I wanted. So that the next early morning, We penned your a summary of range facts and you may numbers. We noticed adding a line to own my charge card expenses. Or even more unnerving, We felt composing separate contours having that which you on my bank card statement.

However, I realized we had currently gone through this action. We’d spending plans to have everything – and amusement. Thus i extra a column for Shaleen’s Entertainment Funds, totaled the list, and delivered it. An hour later an email displayed me which he had generated the latest import towards the my personal membership and place an auto-transfer for the same matter per month.

I did not provides a set plan for whenever I would get back to be effective, but We presumed one I might get back seemingly appropriate brand new baby emerged. That’s what I imagined – until I discovered that the expenses from Massachusetts day care mediocre so much more than I taken care of university ($sixteen,000 per year). So i continued to keep house for a time.

Once i turned accountable for full-time child worry, We never believed self-conscious about not adding a paycheck once again – generally because the I did not loans Hamilton Georgia have time feeling thinking-conscious about things (evaluator at the least enable you to simply take toilet vacation trips; toddlers burst from home shouting).

You to definitely short, personal, no-questions-requested recreation loans enjoys acceptance me to look after my personal financial self-respect. Not merely do that money wade entirely on my personal wishes and needs, but i have freedom more than how best to invest it.

Now I’ve become my own personal company just like the an employer, and that i think its great, even in the event investing in the business will bring its own selection of complexities. Now, I’m grateful that people set-up a collectively polite cost management system very early, but I however completely accept that there needs to be economic guidance to have stand-at-home mom

More on HERMONEY:

- An educated Budgeting Methods for Your own 20s and 30s

- The reason we Feel FOMO and the ways to Beat They

- Perform Female You prefer Big Disaster Financing Than simply Guys?