Within the obtaining a home-collateral financing one thing to remember is the fact i come into a time period of ascending interest levels

Beloved Rick: I have a challenge that i pledge you could assist me that have. I’m during my middle 40’s and you may about 2 yrs in the past I’d divorced. We had been in a position to handle what you without the matches otherwise drama. At the time of brand new split up I wanted to keep our very own family therefore my partner, exactly who treated all our earnings, better if I take a loan out-of my personal 401(K) Want to pay their own out-of to the house, that we did. This past year, I quit my personal work and you may had an alternate employment. My employer was not pleased since the newest work is which have a rival. I don’t have the money to repay the loan. My first question for you is can they do this? I do believe that they are punishing myself to possess going to a rival. My personal second question is what goes on if i try not to pay back the latest loan; exactly what do they do? As well as, people pointers that you may have in how to manage this example could be beneficial. Jeff

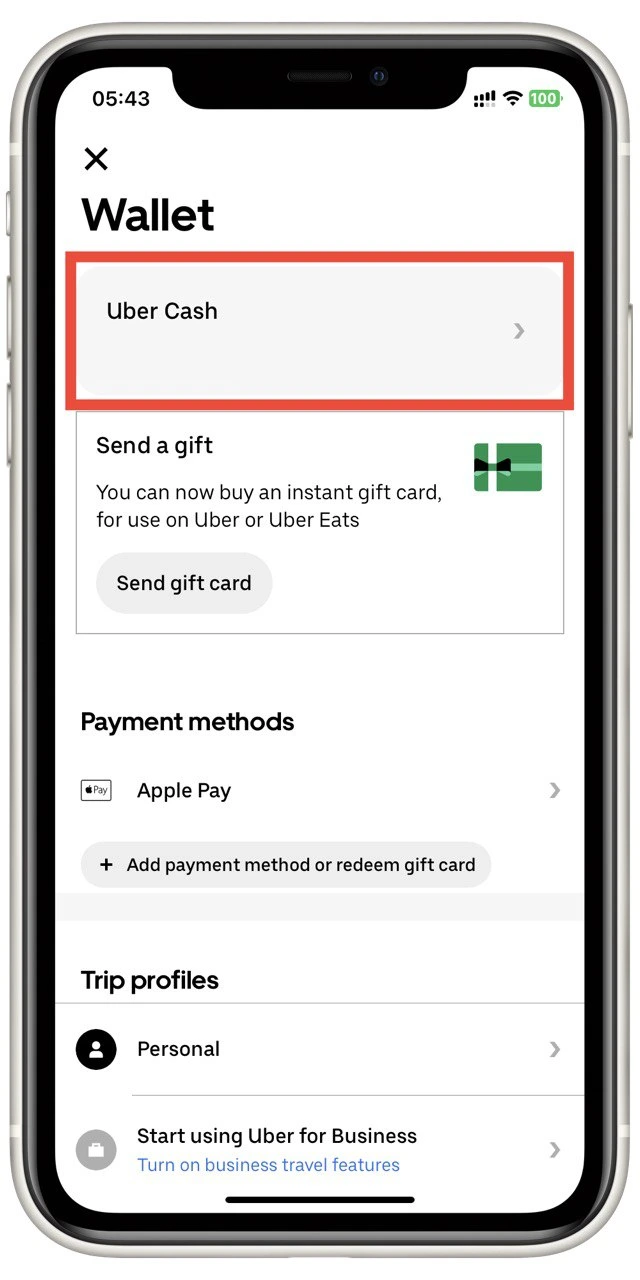

And additionally examining along with your current mortgage company, in addition it is beneficial discuss with a card commitment you are able to fall under or perhaps to store cost on the internet which have credible people

Beloved Jeff: When your ex-manager will be vindictive or perhaps not is relatively immaterial. When taking a beneficial 401(k) Bundle, an element of the terms of a loan is that the loan gets due generally 60 so you can https://www.elitecashadvance.com/payday-loans-co/ ninety days after you get-off your own a career. Ergo, the company is actually really inside their legal rights to help you request commission. Even though 401(k) Agreements are easy to obtain from, one of the drawbacks is the fact finance become owed when you log off brand new workplace.

Pertaining to the second matter, if you don’t pay off the mortgage, following just what boss does are address it once the a distribution. Exactly what that implies is that you can pay taxes on that currency. Such, for folks who lent $twenty five,000 from the 401(k) therefore didn’t pay back brand new $twenty five,000, you to definitely $twenty five,000 is taxed for your requirements as typical earnings. Simultaneously, as you are significantly less than 59?, it cash is addressed since an early shipments and thus, this new Irs, and the taxes, often determine your a 10 % punishment for very early shipment.

Inside examining your position, as you do not have the information to settle the borrowed funds, one opportunity I’d mention will be a home collateral financing. A house-security loan would allow one to utilize the fresh equity into your residence at the a relatively discount. Even though, rates have left up-and I greet they’re going to keep to increase, home-guarantee finance continue to be apparently reasonable. At exactly the same time, the attention you have to pay on your household-guarantee financing try tax-deductible. Therefore, my personal advice is that in order to prevent the newest 10% punishment and having to understand extra earnings, thought a home collateral mortgage.

Just like whenever you borrow money, it can spend to shop domestic-collateral loans around. Not totally all companies have a similar pricing otherwise fees. You will be amazed what kind of cash you could potentially rescue because of the looking around.

In most domestic-equity money the pace was varying meaning that once the interest rates rise, very will the attention you have to pay on your family-collateral financing.

Fundamentally, I am not saying keen on credit currency one to one’s home; however, in cases like this it seems sensible. An individual asks me on the credit to their the home of get vacation to purchase an alternative large-monitor Tv, I’m fundamentally perhaps not into the prefer or one. However, if someone else borrows to their home to pay a different sort of introduction such as the one at hand otherwise a high interest rate bank card, I’m essentially and only one. I accept that as soon as you borrow cash you ought to use caution and make sure your currency you may be borrowing is actually maybe not likely to be frivolously spent.